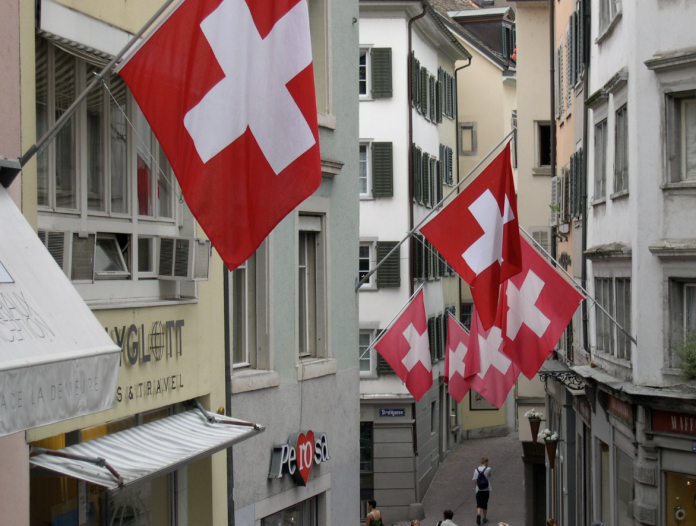

Navigating the complexities of U.S. tax regulations from abroad can be a daunting task for American expats. Fortunately, there are specialized services designed to simplify this process, ensuring compliance and peace of mind. This article highlights a reputable provider of U.S. expat tax services tailored specifically for U.S. citizens residing in Switzerland.

Comprehensive Tax Preparation Services

U.S. tax obligations do not end when one moves overseas. For American expats living in Switzerland, staying compliant with U.S. tax laws is crucial. Professional tax services offer comprehensive assistance, including the preparation of essential forms such as F1040, F5471, F8858, and F8992. These services ensure that all filings are accurate and submitted in a timely manner.

Seamless and Secure Online Process

The convenience of online tax services cannot be overstated. U.S. expats can enjoy a seamless and secure process for sending their documents and completing their tax returns. This digital approach not only saves time but also provides a layer of security, ensuring that sensitive personal information is protected throughout the process.

Expertise in Expat Tax Matters

When it comes to U.S. expat tax filings, expertise is key. Enrolled Agents who specialize in expat tax issues offer invaluable assistance. Their deep understanding of the intricacies of U.S. tax law as it applies to residents abroad enables them to provide thorough and accurate service. This expertise is particularly crucial for those who encounter administrative challenges or need guidance on specific tax-related issues.

Client Testimonials

Feedback from clients provides insight into the quality and reliability of tax services. Many U.S. expats have expressed high satisfaction with the level of service provided, highlighting the ease of document submission, the speed of service, and the qualifications of the Enrolled Agents. Testimonials often note the proactive assistance received in addressing administrative problems and the valuable guidance provided throughout the tax filing process.

Conclusion: Why Choose Professional Expat Tax Services?

For U.S. citizens residing in Switzerland, professional tax services offer a straightforward solution to meet their U.S. tax obligations. With expert advice, secure online processes, and a focus on compliance, expats can navigate their tax responsibilities without stress. Whether it’s handling complex forms or providing quick responses to queries, a dedicated tax service for expats makes all the difference.

Contact Information for U.S. Expat Tax Services

For further details or to start the process of your U.S. tax filing from Switzerland, expats are encouraged to reach out via the contact page of the service provider. Ensuring timely and accurate tax submissions is just an inquiry away.

Affordable U.S. Expat Tax Services

For More Information : https://ustaxfiling.ch/